Morgan Housel famously said, “Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.”

Today, we’re going to introduce you to a smart investing strategy that you can use to optimize your FD investments!

What is FD Laddering?

Chances are you’ve been in unforeseen situations like booking an FD, needing some money unexpectedly, and wondering if you should break it.

FD laddering is a smart investment strategy that helps you gain liquidity, minimize risk, and maximize returns. The best part? Implementing it adds practical value to your life.

All you have to do is divide your total investment amount across FDs with different durations and interest rates.

The steps are fairly simple:

Divide your total investment amount into equal or varying portions

Invest each portion in a separate FD with a different duration & interest rate

As each FD matures, you can choose to reinvest or withdraw the funds

How can you start FD Laddering?

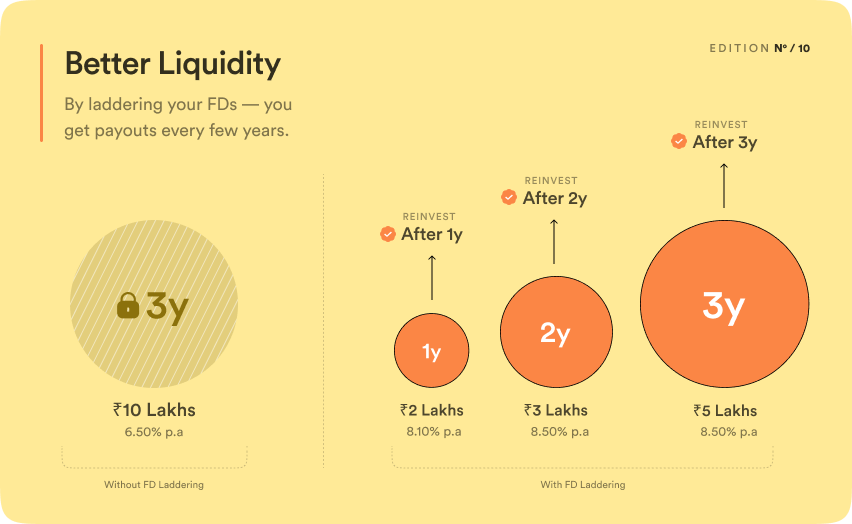

Say, you have one ₹10 Lakhs FD at 6.50% for a 3Y tenure. Did you know there’s a better way to treat your investment?

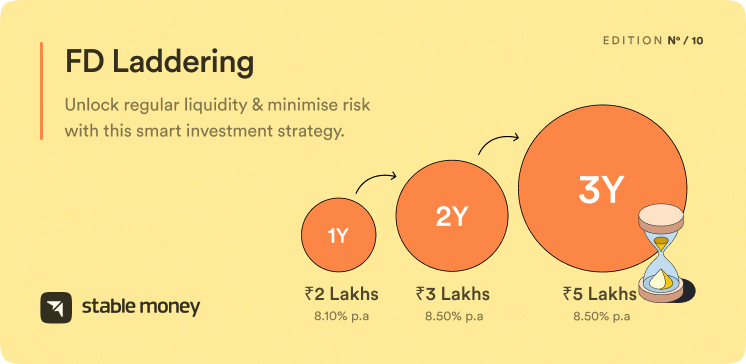

Take an example from Stable Money FDs — you can split your amount into 3 FDs.

The first FD is for ₹2 Lakhs in Shivalik SF Bank — for 1Y at 8.10% per annum.

The second FD is for ₹3 Lakhs in Utkarsh SF Bank — for 2Y at 8.50% per annum.

The third FD is for ₹5 Lakhs in Utkarsh SF Bank — for 3Y at 8.50% per annum.

It’s an extremely simple and effective strategy that goes unnoticed. Thus, we’ll dive deeper into it.

What are the biggest reasons to do FD Laddering?

Better Liquidity

Liquidity is one of the best benefits of this strategy. If you do one large FD, but end up breaking your FD later, it can lead to a loss of interest earned and premature withdrawal penalties.

However, by laddering your FDs — you get payouts every few years in line with your financial goals and unplanned future needs.

Maximize Safety

The other reason to ladder your FDs is to minimize risk. People think diversification is just about putting your eggs in different baskets. However, that’s not true. When you ladder your FDs in different banks, you can make optimal use of the DICGC ₹5 lakh insurance.

The DICGC insures principal and interest up to a maximum amount of ₹5 lakhs per bank. At Stable Money, all the banks we partner with are RBI-insured.

When you ladder your FDs, you can get more than ₹5 lakhs RBI insurance coverage!

Balance Reinvestment Risk

Furthermore, FD laddering ensures that your reinvestment risk is balanced out.

With just one large FD, on the date of maturity, your new investment will be limited by rates at that time.

However, if you split your deposits into 3 FDs at different rates and different time intervals, then each FD will renew at 1 year, 2 years, 3 years and offer better average returns.

Stable Money #Pro Tip

It is advised that when rates are high, for example in 2023, you should book multiple FDs for longer tenures and ladder via them.

Hear from Kirtan Shah, Co-Founder & CEO, Financial Planning Academy

We really hope you enjoyed this edition. If you found it helpful, please do share it with your friends and family. It will absolutely make our day.

We’ll keep sharing successful strategies so you can become a better investor!

Best,

Team Stable Money

Nice