Did you know that every festival season consumer spending in India reaches billions? In 2022, it was upwards of $30 billion.

Of those planning to spend during the festive season, if households saved roughly 20% of estimated spend, that’s $6 billion more that could grow further via investments.

Yuval Noah Harari rightly said, “Money was created many times in many places. Its development required no technological breakthroughs — it was a purely mental revolution.”

There is a common mental model that we subscribe to: you save for tough times and spend for good times. The problem with this mindset is that we limit our investing model to an un-optimistic future.

We get our paychecks or have a good business year and immediately start filling out our expenses. Of course, paying our dues is Step 1. Though, what comes next?

We don’t spend enough time thinking about growing our remaining income. In fact, we often leave it in a savings account or follow the advice of a friend.

At Stable Money, we believe actively ‘thinking’ about investing is the first step in your journey!

#Golden Rule 1

The general rule of thumb is to invest 15-20% of your income. The classic 50/30/20 budgeting strategy states that your after-tax income should be divided into three categories: needs, wants, and savings.

50% of your income should go towards needs such as rent, food, and utility bills. 30% can go towards wants such as shopping, dining out, etc.

Finally, 20% of your income should go to savings such as investments in Equities, Fixed-Income instruments, and Gold.

Though, real life is not as straightforward. We find that there are certain months wherein our expenses are bloated. Or times wherein we’re forced to break into our savings.

To prepare for real life, we must ensure that a sizeable portion of our portfolio is stored in safe assets.

Golden Rule #2

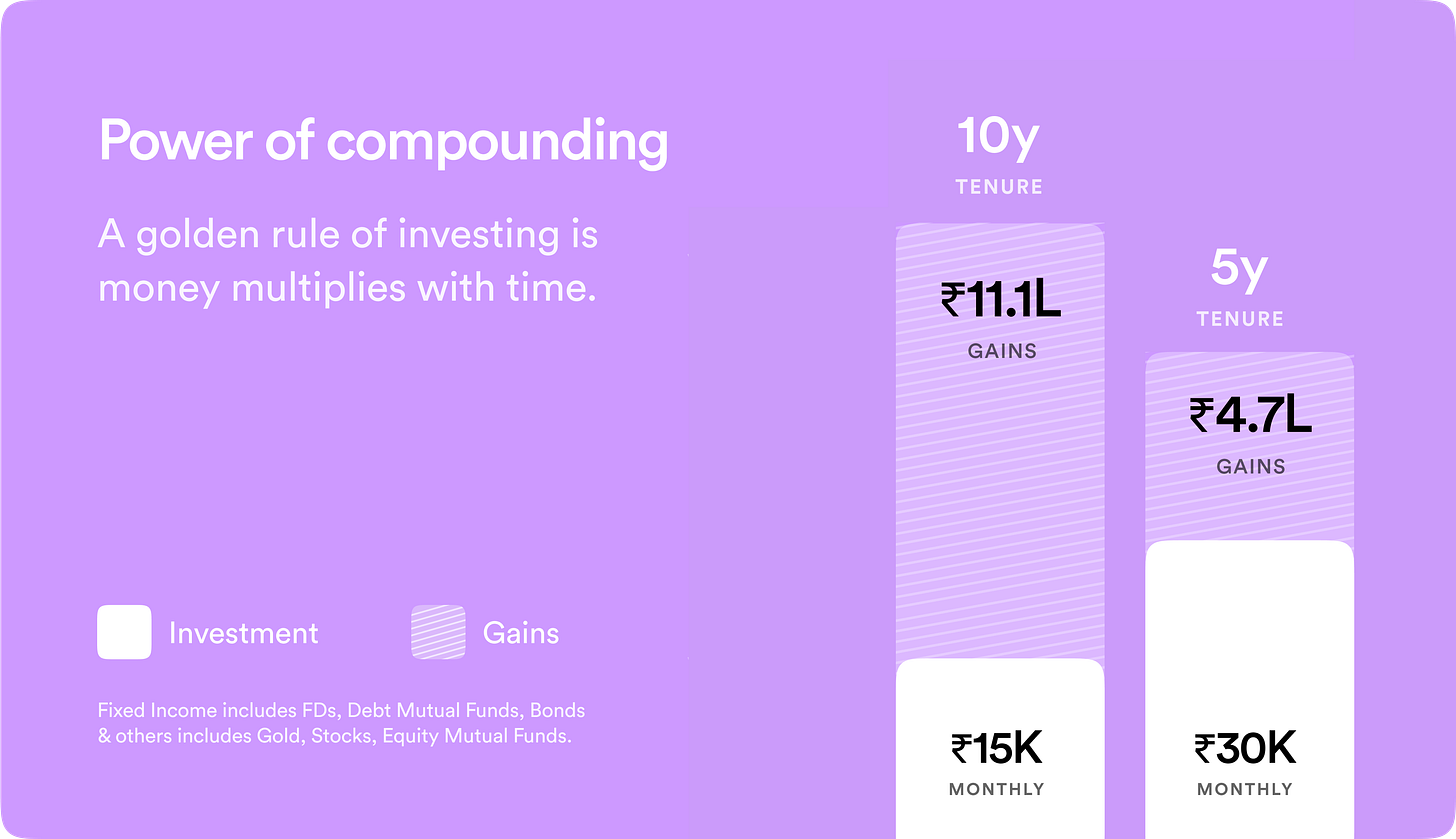

Another golden rule of investing is that money multiplies with time. It’s not always about investing the highest amount, but consistently investing a portion of your income for a long time.

For example, if you invest ₹15,000 from age 25 to 35 vs. investing ₹30,000 from age 30 to 35. Both at 9% — compounding quarterly.

Where will you make more long-term gains? You’ll be surprised at what the compound interest equation decodes.

Einstein called the compound interest equation the 8th wonder of the world. You too can apply this powerful formula in your life. The earlier you start investing — the greater your chances of building long-term wealth.

Golden Rule #3

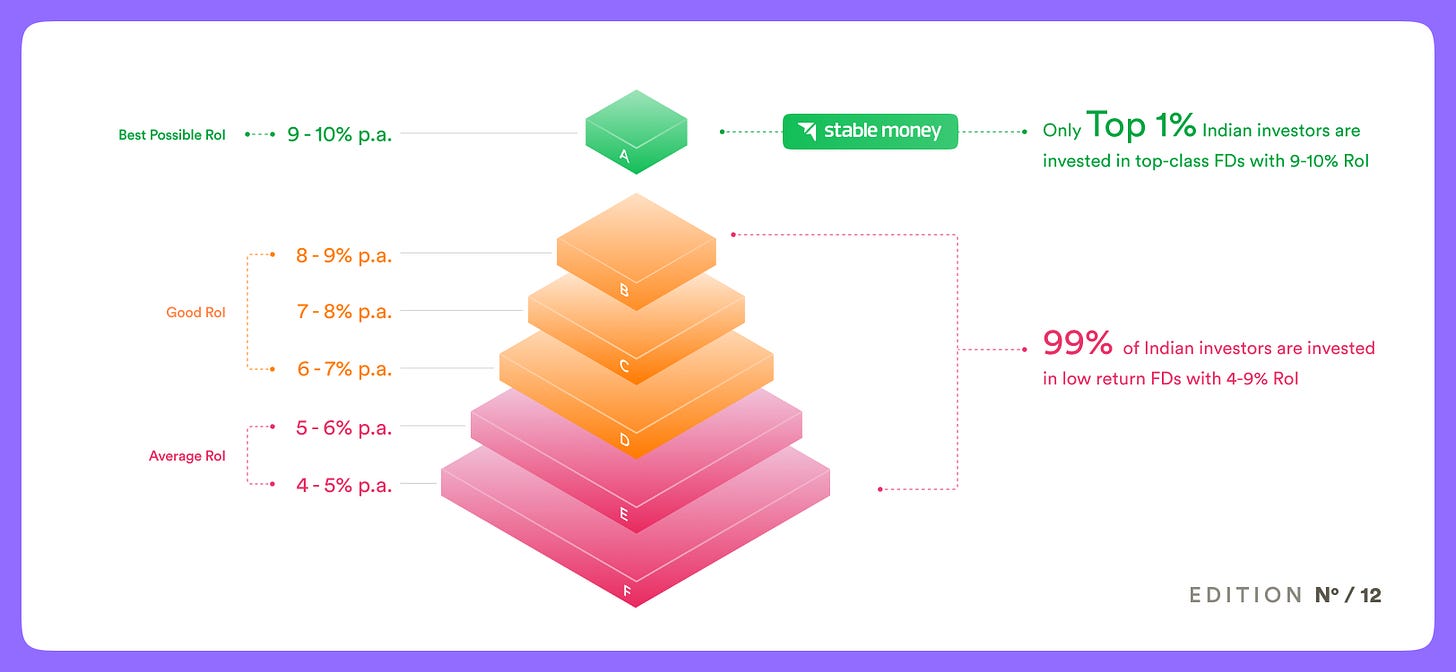

Another golden rule of investing is, “Invest in what you understand”. At Stable Money, we know that 32% of an Indian household’s savings are in FDs. Our job is to elevate this habit of yours and ensure you’re a top 1% FD investor.

Did you know? 93% of fixed deposits in India today earn less than 8% p.a.! To put this into context, the average Stable Investor makes over 8.5% p.a. returns on their deposits.

As per RBI data, here’s what the Indian FD landscape looked like in June 2023.

Best,

Team Stable Money