Today, we’ll give you a deep dive into one of our most popular banks 🥁

Utkarsh Small Finance Bank is a leading small finance bank that offers FD interest rates up to 8.50%, has an extensive network of 847 branches, and is insured by the RBI up to ₹5 lakhs.

This is the first time in the bank’s history that you can book FDs digitally!

There’s no need to open a new bank account, there’s no need to be available for a long offline booking process, and there’s no need to delay your investment.

You can now book your FD digitally on the Stable Money app — in under 3 minutes.

Now, since you know how easy it is, let’s take you through all the reasons why you can invest in Utkarsh SF Bank.

The key areas to evaluate Utkarsh SF Bank on are -

Interest rate: It’s most recommended FD offers an 8.50% interest over a 2YR tenure. For senior citizens, it’s a 9.10% interest over a 2YR tenure.

Quarterly compounding: You’ll get an assured 8.77% annual return, thanks to quarterly compounding!

Senior citizens will get an assured 9.41% annual return, thanks to quarterly compounding.

Assets under management & banking branches: (AUM) of more than ₹6,000 crore across 847 branches

Safety: All investments up to ₹5 lakh are RBI-insured

Lock-in: The lock-in period is just 7 days

Video KYC: A simple 2 mins verification process

Stable Money partner: You’ll get a digital FD receipt after your booking!

Trust in a bank is the most important aspect of your investment decision. The second factor is understanding why their FD offering is best suited for you.

Today, we’ll share small customer case studies to explain why Utkarsh SF Bank FD is a good investment.

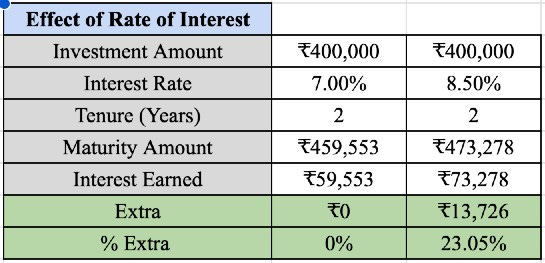

Leela D’Souza had an FD in the same account as her parents. It offered her 7.00% for a tenure close to 3 years. She didn’t even know there were other options!

Now, she’s moved her money to Utkarsh SF Bank’s most recommended FD that offers an 8.50% interest over a 2YR tenure. The best part is that since her money is RBI insured up to 5 lakhs, she can enjoy a higher interest rate, at the same low risk.Megh Singh was very keen on only investing in products that beat inflation and helped him grow his money. His friends convinced him to explore P2P lending which offered up to 9%.

Eventually, he decided to move his money. He realized that an FD could offer him an assured 8.77% annual return, thanks to quarterly compounding! So why bear any additional risk?

Amit Jain learned the hard way just how much percentage interest he was losing out on! He won’t make the same mistake again.

Another important factor to consider is the bank’s public standing.

Did you know? After an overwhelming response to the IPO, shares of Utkarsh Small Finance Bank were listed at a robust premium of 60% over the issue price.

The initial public offering (IPO) of Utkarsh Small Finance Bank Ltd was subscribed 101.91 times on Day 3 itself!

Lastly, Stable Money customers love Utkarsh SF Bank!

54.98% of bookings on the app are on Utkarsh SF Bank.

Plus, 900 folks have enjoyed a 1-click booking experience and made 2 FDs in Utkarsh SF Bank.

Post Video KYC, your 2nd booking takes less than a minute!

Hope you enjoyed this deep dive! We’re always here to ensure you make the best investment decisions possible.

Best,

Team Stable Money